In cases in which consumers don’t have enough money to pay the required down payment amount for an automobile purchase, car dealerships sometimes allow them to make “deferred down payments.” A deferred down payment is any portion of the down payment that you agree to pay the dealer on a date after you sign the contract. Agreeing to pay the dealer more money in two weeks or giving the dealer a post-dated check are both examples of deferred down payments. However, in a surprisingly large number of vehicle purchase transactions, car dealers deliberately fail to disclose the existence of deferred down payments in auto purchase contracts.

In cases in which consumers don’t have enough money to pay the required down payment amount for an automobile purchase, car dealerships sometimes allow them to make “deferred down payments.” A deferred down payment is any portion of the down payment that you agree to pay the dealer on a date after you sign the contract. Agreeing to pay the dealer more money in two weeks or giving the dealer a post-dated check are both examples of deferred down payments. However, in a surprisingly large number of vehicle purchase transactions, car dealers deliberately fail to disclose the existence of deferred down payments in auto purchase contracts.

Failing to disclose a deferred down payment in an automobile financing transaction is probably one of the most common illegal tactics utilized by California car dealerships. The reason that car dealers hide deferred down payments is to get consumers financed for auto loans for which they otherwise would not qualify. While some consumers might be grateful for the opportunity to obtain financing, it also has the result of signing consumers up for loans that they cannot afford.

Fortunately, California’s auto financing statute (the Automobile Sales Finance Act) is EXTREMELY strict. It basically mandates that car dealers must accurately make all of the disclosures specified in the statute, and declares that a dealership’s failure to do so renders the contract voidable by the consumer. That means that if the car dealer failed to properly itemize your deferred down payment, you probably have a right to cancel the contract and receive a refund (subject to an offset for the mileage that you drove the vehicle prior to canceling).

So How Can I Tell if the Dealer Falsified My Deferred Down Payment Amount?

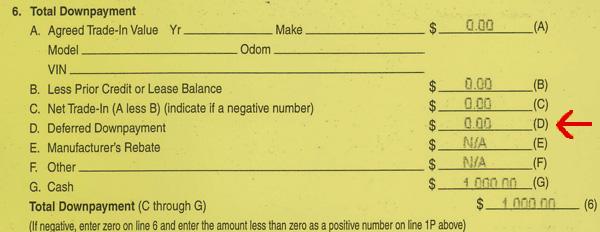

If you made a deferred down payment when you purchased your car, truck, or SUV, you can check to see if it is properly documented by looking at the “Total Dowpayment” section of your purchase contract. This section is located (as pictured below) at Item No. 6 in the “Itemization of Amount Financed” section.

Look at the line item “Deferred Downpayment.” If it lists the amount of your deferred downpayment, then the dealership did it properly. But if the contract states that the deferred downpayment amount is “0.00” or “n/a” and the dealer combined your deferred down payment together with your immediate down payment, and listed the whole amount as a cash down payment, then you likely have a grounds for canceling the contract based on the dealer’s falsification of your deferred downpayment amount.

The picture above shows an improperly documented deferred down payment in which a consumer paid $500 down immediately, and agreed to pay another $500 two weeks later. As you can see, the dealer combined the two amounts and disclosed the entire $1,000 as a cash down payment, but falsely stated that there was no deferred down payment whatsoever.

Want to Talk to a Lemon Law Attorney About Your Purchase Contract?

If you think that a car dealer failed to disclose your deferred down payment, or otherwise violated California’s automobile-financing laws, then call the Vachon Law Firm at 1-855-4-LEMON-LAW (1-855-453-6665). We offer free consultations and take deferred down payment cases on a contingency fee basis for no money down.

Call us today to learn if you are entitled to unwind your contract!

- Back to Car Dealer Fraud Page

- Back to Lemon Law Attorney Home Page